Unexpected disruptions are rising worldwide, including flight cancellations, severe weather, digital-nomad health claims, and new European border controls.

Travel insurance turns those risks into manageable costs, so you keep moving instead of draining savings.

Travel Insurance Is Non-Negotiable in 2025

Unexpected costs strike harder than ever; therefore, a solid policy shields both budget and itinerary.

Flight and Operational Disruptions

Airlines cancelled more than 250,000 flights last year, and premium policy sales surged in response. Travelers are paying extra for Cancel for Any Reason clauses because automatic rebooking rarely covers hotels or tours.

Medical Bills Abroad

A broken ankle in Tokyo can top US $20,000 after surgery and repatriation.

Comprehensive coverage pays those invoices directly to hospitals, which means you avoid large credit-card holds or personal loans.

Trip Cancellation and Interruption

Illness, family emergencies, natural disasters, or new visa rules can derail plans. Reimbursement clauses recover non-refundable flights, hotels, and activities, keeping long-saved funds intact.

Baggage, Gear, and Gadgets

Lost luggage still ranks among the top five complaints filed with insurers worldwide. Digital-nomad policies now add gadget protection up to US $3,000 for laptops and cameras.

Long-Stay and Remote-Work Stays

Remote professionals spend months abroad, which in turn drives demand for annual multi-trip or long-term health options that include mental-health teleconsultations and mail-order prescriptions.

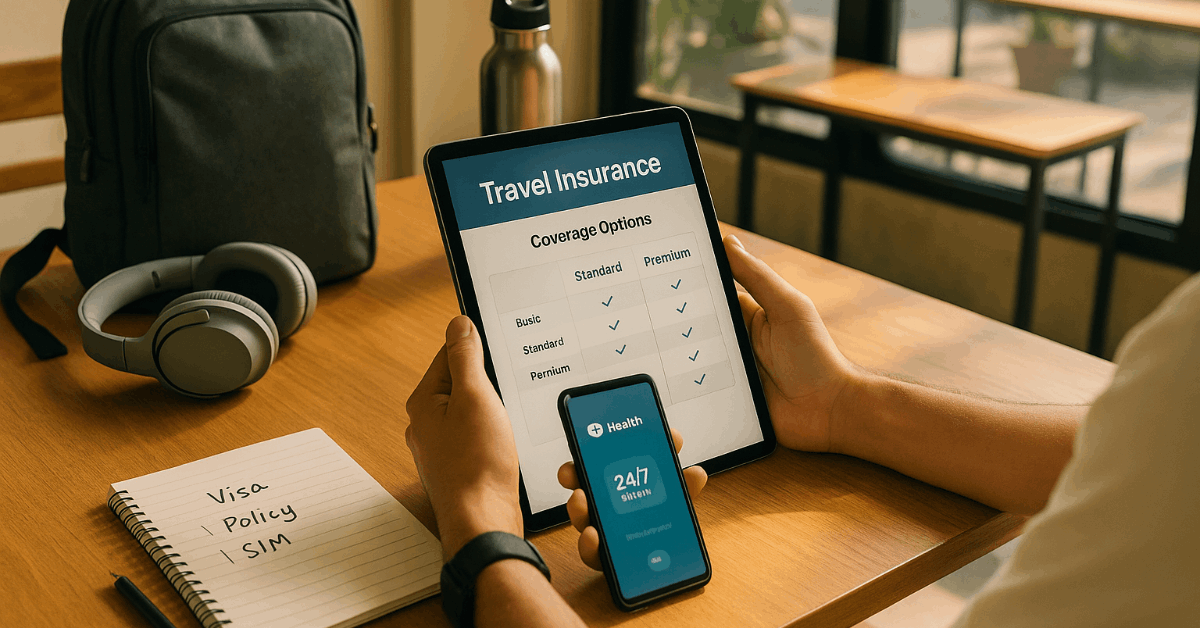

Core Coverage Types and What Each Does

Missed connections cost money and time; as a result, choose a policy type matching travel frequency and risk profile.

| Coverage Type | Typical Duration or Trip Count | Core Benefits | Ideal User |

|---|---|---|---|

| Single-Trip | One itinerary up to 180 days | Medical, cancellation, baggage | Occasional vacationer |

| Annual Multi-Trip | Unlimited trips, 30–90 days each | Same as single-trip; one contract covers all | Frequent flyer, regional commuter |

| Comprehensive | Custom limits plus add-ons (adventure, CFAR, gadgets) | Broadest protection, higher limits | Long-haul explorer, cruise passenger |

| Specialty (Digital Nomad, Adventure, Cruise) | 1 month–18 months | Tailored benefits such as remote-work gear or high-risk sports | Remote worker, climber, sailor |

| Parametric | Any trip length | Automatic payouts for flight delays or weather | Travelers who value instant compensation |

How to Choose the Right Policy

A last-minute buy usually costs more; that way, start selection the day flights are booked.

Match Trip Profile to Benefits

Duration, destination health-care prices, climate hazards, and planned activities dictate minimum coverage limits.

Check Benefit Caps

Medical limits of at least US $100,000 are recommended; Schengen states still require €30,000 minimum for entry visas.

Review Exclusions First

Look for adventure-sport clauses, alcohol-related incidents, and civil-unrest carve-outs; negotiate an adventure add-on if zip-lining or diving.

Compare Providers

Evaluate financial strength ratings, claim-processing speed, and app usability.

Calculate Value, Not Price Alone

A cheaper plan with lower baggage limits can become costly when a US $1,400 camera disappears.

Exclusions and Limitations You Cannot Ignore

A sudden claim denial ruins confidence, which means reading policy fine-print matters.

- Pre-Existing Medical Conditions unless a medical-waiver upgrade is purchased.

- Extreme Sports such as heli-skiing, mountaineering above 6,000 meters, or base-jumping.

- Reckless Behavior involving alcohol, drugs, or unlicensed vehicle use.

- Acts of War or Terrorism unless explicit coverage is included.

- Travel to Sanctioned Regions; coverage may void automatically.

Key International Considerations in 2025

Security checks tighten every quarter, so proactive coverage helps satisfy new entry rules and health demands.

European EES and Upcoming ETIAS

The EU Entry/Exit System starts phased implementation on 12 October 2025, logging biometric data at borders.

ETIAS authorization, initially scheduled for 2025, now moves toward a 2026 launch, yet proof of insurance remains compulsory for many visas. Carry confirmation letters formatted with full policy limits in euros.

Mandatory Medical Minimums

Many countries demand proof of medical coverage on arrival—Thailand (US $50,000), Cuba (any amount that covers COVID-19), and the entire Schengen zone (€30,000).

Pandemic and Epidemic Cover

Several insurers have introduced COVID-19 “endemic” riders. Without this add-on, quarantine costs can become out-of-pocket expenses.

High-Risk Activities and Climate Events

Hiking through Patagonia’s winter or surfing Indonesia’s cyclone season increases injury probability, therefore specialty adventure add-ons remain sensible.

Digital Services and Telehealth

Apps such as Heymondo’s 24/7 chat connect travelers with doctors worldwide, reducing language barriers and accelerating treatment approvals.

Smart Policy Management Tips

Lost PDFs help nobody; secure digital and physical copies for rapid presentation.

- Purchase Within 24 Hours of Booking to enable robust cancellation benefits.

- Bundle Trips on an Annual Plan for cost savings if traveling more than three times per year.

- Store Digital Copies in cloud drives and on phone wallets, plus a paper copy in checked baggage.

- Use Insurer Apps for location-based hospital referrals and claims submission.

- Enable Push Alerts about severe weather or civil unrest, ensuring quick itinerary adjustments.

- Extend or Renew Before Expiry; some providers allow mid-trip extensions through app toggles.

- Save Hotlines Offline to bypass patchy roaming service.

Filing a Claim Without Stress

Claim denials often stem from missing paperwork; as a result, gather evidence immediately.

- Notify the Insurer First through phone, email, or app chat.

- Collect Documents—police reports, hospital invoices, airline delay notices, boarding passes.

- Photograph Damaged Items before repair or disposal.

- Submit Within Policy Time Limits (commonly 20–30 days post-event).

- Track Progress Online and answer follow-up queries promptly.

- Escalate to Ombudsman or credit-card dispute channels if unfairly denied.

Common Mistakes That Cost Travelers Money

Buying coverage that excludes connecting flights under separate tickets. Ignoring deductible levels, which in turn reduces small reimbursement values to zero.

Overlooking documentation requirements for lost-baggage receipts.

Assuming personal-liability coverage is identical worldwide—it often caps at US $500,000 in North America but much lower elsewhere.

Quick Reference Comparison

| Feature | Single-Trip | Annual Multi-Trip | Comprehensive | Digital Nomad |

|---|---|---|---|---|

| Medical Limit (typical) | US $100k | US $150k | US $250k+ | US $500k |

| Trip Cancellation | ✔ | ✔ | ✔ | Optional |

| Baggage Cover | ✔ | ✔ | ✔ | High Gadget Limit |

| Adventure Sports | Add-on | Add-on | Included | Included |

| Cancel For Any Reason | Rare | Rare | Available | Available |

| Telehealth App | Sometimes | Sometimes | Usually | Always |

| Ideal Traveler | One annual holiday | Frequent flyer | Luxury or complex trip | Remote worker, long stay |

Final Check-List Before Departure

A last scan avoids bureaucratic headaches. Confirm policy number, emergency contacts, and coverage limits both digitally and on paper. Review local entry rules for insurance wording (currency, minimum amount, insurer country).

Activate roaming or purchase an e-SIM for quick insurer communication. Share policy details with a trusted contact at home. Verify credit-card benefits, then supplement gaps with standalone coverage rather than duplicating protections.

Your itinerary, gear, and health remain far safer behind a robust travel-insurance shield. Comprehensive planning delivers freedom to enjoy each worldwide journey—knowing contingencies are funded and assistance teams stand ready wherever borders open next.