The crypto market in 2025 is more advanced and regulated than ever, but choosing the right exchange still matters.

With security threats and scams on the rise, trusting your platform is essential.

This review highlights the most reliable crypto exchanges you can use with confidence this year.

What Makes a Crypto Exchange Trustworthy in 2025?

Not all crypto exchanges are built the same. In 2025, trust is earned through transparency, compliance, and user protection.

When choosing a platform, you need to look beyond marketing and focus on key safety features.

Here are the factors that define a trustworthy crypto exchange today:

- Regulatory Compliance: The exchange should be licensed or registered in at least one reputable jurisdiction.

- Security Measures: Look for 2FA, cold wallet storage, insurance policies, and regular security audits.

- Transparent Leadership: A public team, clear company information, and accountability build user confidence.

- User Protection Policies: Refund procedures, bug bounties, and withdrawal security are signs of responsibility.

- Positive User Reputation: Check community feedback, social media sentiment, and third-party reviews.

- Operational History: Exchanges with years of stable service and no major hacks are generally safer.

- Clear Terms of Service: Legal documents should be readable and outline your rights as a user.

Top 7 Crypto Exchanges to Trust in 2025

In 2025, the crypto landscape is dominated by platforms that combine advanced features with proven security.

These exchanges stand out for their transparency, compliance, and consistent user satisfaction. Each one offers unique strengths depending on your needs.

Here are the top 7 most trusted crypto exchanges this year:

Binance

Binance is a global leader in crypto trading with powerful tools and deep liquidity. It’s suitable for both beginners and advanced traders.

- Available on Android and iOS.

- Wide selection of coins and trading pairs

- Advanced trading tools and intuitive mobile app

- Strong global presence and high liquidity

- Offers Proof-of-Reserves and SAFU insurance

- Known issues with regional regulation (varies by country)

Coinbase

Coinbase is a U.S.-regulated exchange designed for beginners who want a simple, safe way to buy and sell crypto.

- Available on Android and iOS.

- Fully regulated in the U.S.

- Beginner-friendly interface and tools

- Offers insured custody for U.S. users

- Publicly traded company (COIN on NASDAQ)

- Higher fees compared to most platforms

Kraken

Kraken is a veteran U.S. exchange known for its security, regulatory compliance, and broad trading options.

- Available on Android and iOS.

- Based in the U.S. with a strong compliance history

- Offers spot, margin, and futures trading

- Transparent proof-of-reserves system

- Excellent customer support reputation

- The interface may be too advanced for beginners

Bybit

Bybit focuses on derivatives and fast trading, with added features like staking and copy trading.

- Available on Android and iOS.

- Strong presence in derivatives and copy trading

- Competitive trading fees and ongoing promotions

- Smooth and responsive mobile app

- Expanding into staking, NFTs, and more

- Limited fiat currency support in some regions

KuCoin

KuCoin is popular for altcoin access and its flexible features like bots and partial KYC.

- Available on Android and iOS.

- Offers hundreds of altcoins and new listings

- Includes trading bots and social trading features

- Halo Wallet is available for self-custody

- Partial KYC allows flexible access

- Security has improved following past issues

OKX

OKX combines traditional trading with DeFi and Web3 tools, catering to users seeking innovation.

- Available on Android and iOS.

- Large international user base with high liquidity

- Web3 wallet integration and DeFi access

- Dual investment and staking features

- Clean interface with positive user reviews

- Restricted in some countries

Bitstamp

Bitstamp is one of the oldest exchanges, offering a simple and secure experience backed by strong regulation.

- Available on Android and iOS.

- Trusted legacy platform with long operational history

- Fully licensed in both the EU and the U.S.

- Supports fiat deposits, withdrawals, and bank transfers

- Focused on reliability and security

- Fewer listed coins compared to newer exchanges

How to Choose the Right Exchange for You

Not every crypto exchange fits every user. The right choice depends on your experience level, goals, and location.

Knowing what to look for will help you avoid unnecessary risks. Here’s what to consider before signing up:

- Your Experience Level: Beginners may prefer simple platforms like Coinbase, while advanced traders might need tools from Binance or Kraken.

- Trading Features You Need: Decide if you want spot trading, futures, staking, or NFTs—some exchanges specialize in certain areas.

- Regulation in Your Country: Make sure the exchange is allowed to operate where you live to avoid frozen accounts or legal issues.

- Fees and Costs: Compare trading fees, withdrawal fees, and any hidden charges that could affect your profits.

- Security Standards: Only use exchanges with cold storage, 2FA, and a solid track record of no major breaches.

- Customer Support: Reliable help matters—check if they offer live chat, ticketing, or 24/7 service in your language.

Common Red Flags in Untrustworthy Exchanges

Before you deposit any funds, it’s essential to spot warning signs. Untrustworthy exchanges often display patterns that experienced users learn to avoid.

Being aware of these can protect you from scams and losses. Watch out for these common red flags:

- Lack of Regulation: If the platform doesn’t mention licensing or regulatory compliance, it’s a red flag.

- Anonymous Team: No public information about the founders or executives usually means poor accountability.

- Too-Good-to-Be-True Promises: Guaranteed returns, high referral bonuses, or unrealistic offers signal a scam.

- No Security Details: If there’s no mention of 2FA, cold storage, or audits, the platform likely has weak security.

- Frequent Withdrawal Delays: Repeated delays or blocked withdrawals without explanation are serious red flags.

- Bad Community Reputation: A flood of complaints, poor Trustpilot scores, or banned subreddit mentions are warning signs.

How Exchanges Handle Customer Support in 2025

Good customer support can make a big difference when you’re dealing with crypto issues.

In 2025, top exchanges invest in fast and accessible support options to keep users informed and protected.

Here’s what you should expect from a reliable platform’s support system:

- Live Chat Support: Most major exchanges offer 24/7 live chat for quick help on fundamental issues like login problems or order delays.

- Email or Ticket System: Complex concerns like account security, identity verification, or transaction disputes are usually handled through email or support tickets.

- Multilingual Support: Trusted platforms now offer assistance in multiple languages to serve a global user base.

- Help Centers and FAQs: Self-service portals with guides, videos, and articles are common for solving basic problems.

- In-App Support: Mobile apps often include chatbots or direct links to support for fast responses on the go.

- Social Media Escalation: Some users get faster responses by messaging official accounts on Twitter or Telegram, though this varies by platform.

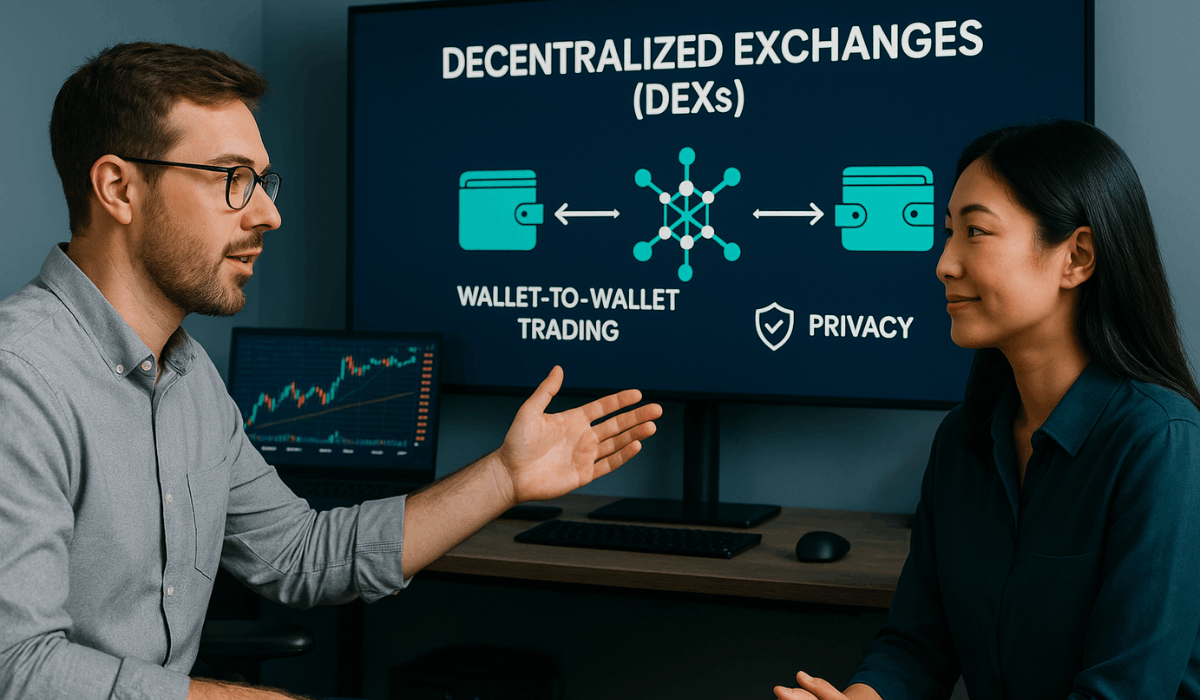

The Role of Decentralized Exchanges (DEXs)

Decentralized exchanges (DEXs) have become more relevant in 2025 as users seek more control over their assets.

Unlike centralized exchanges, DEXs let you trade directly from your wallet without intermediaries. Here’s what you need to know about their role today:

- User Control: You keep full custody of your crypto—no need to deposit funds into a platform-controlled wallet.

- Privacy: Most DEXs don’t require KYC, making them attractive for privacy-conscious users.

- Token Variety: DEXs often list newer or niche tokens that aren’t available on centralized exchanges.

- Smart Contract Risks: Trades rely on code, which can be vulnerable to bugs or exploits if not audited.

- Liquidity Concerns: DEXs may have lower liquidity than centralized platforms, which affects large trades.

- Cross-Chain Innovations: Many DEXs now support trading across multiple blockchains through bridges or wrapped assets.

The Bottomline

Choosing a trustworthy crypto exchange in 2025 is key to protecting your funds and trading with confidence.

The best platforms offer strong security, transparent operations, and responsive support.

Do your research and start with one of the top exchanges listed here to trade safely today.