Premiums keep climbing worldwide, yet you still control plenty of cost-cutting levers.

The methods below show how to trim your car insurance bill while protecting everything that matters.

Understand What Drives Your Premium

A clear view of pricing factors makes every later step easier, which means you can prioritize tactics with the biggest payoff.

- Vehicle profile – Repair costs, safety ratings, theft statistics, and even paint color affect risk assessments.

- Driving history – Tickets, at-fault accidents, and claims frequency push rates higher for three to five years.

- Mileage – Fewer annual kilometers signal lower exposure, reducing what you pay.

- Credit standing – In most regions, stronger credit correlates with lower claim probabilities, so insurers reward solid scores.

- Coverage mix and deductibles – Full coverage with a low deductible costs more than liability-only protection with a higher one.

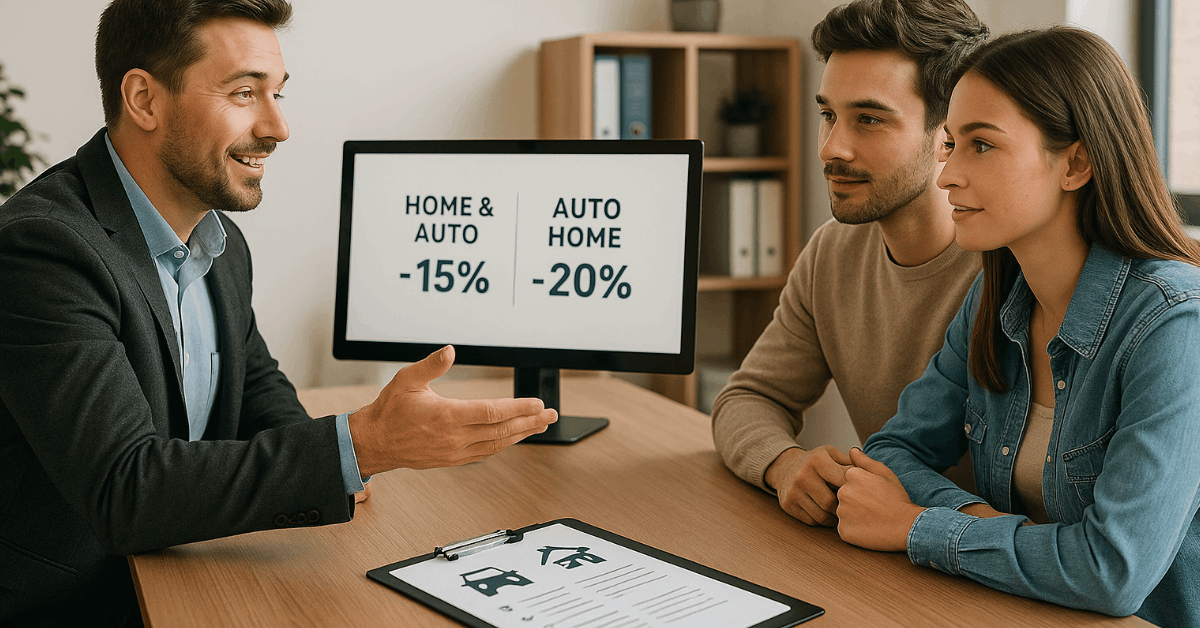

1. Bundle Policies for Immediate Savings

Loyalty counts; therefore, combining auto with home or renters insurance often unlocks double-digit discounts that single-policy holders never see. Multi-policy reductions usually range from 10% to 25%.

Separate companies sometimes beat a single carrier’s bundle, so compare both routes.

Reevaluate annually because bundle pricing shifts as insurers chase market share.

2. Add Every Eligible Vehicle or Driver to One Contract

Managing several separate policies drains cash, whereas a single multi-car plan leverages “bulk” pricing. Teens cost more, yet good-student credits can offset part of the jump.

Unrelated roommates sharing ownership may also qualify if both names appear on the title.

3. Select a Deductible You Can Comfortably Afford

Higher deductibles cut premiums, in turn freeing monthly cash. Aim for an amount you can pay from savings without borrowing.

Doubling a $500 deductible to $1 000 can slash collision or comprehensive costs by up to 40%. Skip the change if emergency funds are thin; a claim would sting harder than the premium relief helps.

4. Review Coverage Once a Year

Life events sneak in silently, which means outdated protection quietly drains money.

Selling an extra car, paying off a loan, or installing new safety tech often qualifies you for fresh discounts.

Schedule an annual policy check-up—mark it on your digital calendar so it never slips.

5. Embrace Usage-Based or Pay-Per-Mile Programs

Safe, low-mileage drivers typically see instant participation credits, then ongoing rewards for gentle habits.

Apps or onboard devices monitor braking, speed consistency, and time of day. Drivers logging under 10 000 miles (16 000 km) annually benefit most.

6. Maintain a Strong Credit Profile

Paying on time and keeping balances low improve both borrowing terms and insurance pricing.

Set automatic payments to avoid late fees and score damage. Check reports three times per year; dispute any errors promptly so insurers use correct data.

7. Choose Cars That Cost Less to Insure

Large pickups and luxury SUVs look impressive; yet, their parts, labor, and theft appeal inflate premiums.

Compare quotes before buying—sometimes a nearly identical trim with a smaller engine saves hundreds annually.

Hybrids or alternative-fuel models often receive eco-friendly discounts of 5% or more.

8. Complete an Accredited Defensive-Driving Course

A short class lowers risk, therefore many carriers shave 5% to 15% off for certificate holders.

Confirm the program meets your insurer’s guidelines before paying tuition. Renew the credential when it expires to keep the credit alive.

9. Reduce Annual Mileage or Commute Smartly

Ride-sharing, public transit, or remote work cuts accident exposure, leading to lower rate tiers.

Document odometer readings or telematics data as proof when requesting an adjustment.

Five thousand fewer miles can bump you into the next discount bracket.

10. Install Verified Anti-Theft and Safety Technology

Theft-deterrent systems, dash cameras, and real-time vehicle trackers deter criminals, which means insurers often respond with premium credits.

Ask your agent for the exact list of qualifying devices before purchase.

Balance hardware cost against yearly savings; aim for a two-year or quicker payback.

11. Drop Coverage That No Longer Adds Value

Older cars sometimes outlive the need for collision or comprehensive insurance.

Calculate the vehicle’s market value; if it is under ten times your annual premium for those coverages, consider removing them.

Keep liability limits high because accident lawsuits can exceed personal savings fast.

12. Stack Lesser-Known Discounts

Small credits accumulate, creating surprising total reductions. Paperless billing, Full-term payment instead of installments, Professional association membership, and Military or educator status

Ask specifically—many carriers do not advertise every option.

13. Work With an Independent Broker

A broker representing multiple insurers shops the market for you, therefore saving time and widening choices.

Independent agencies spot hidden promotions across several companies.

They negotiate custom endorsements when your situation defies one-size-fits-all policies.

14. Compare Quotes at Renewal—Every Single Year

Rates change constantly worldwide, and loyalty rarely guarantees the best deal.

Collect at least three comparable offers 30 days before renewal.

Evaluate financial strength through independent rating services to ensure claim payments remain rock-solid.

15. Keep Your Record Clean

Tickets inflate premiums quickly; safe conduct behind the wheel keeps money in your wallet.

Use in-car reminders or speed-limit alerts if you drive long stretches daily.

Contest any citation you believe is incorrect—removing a point protects your rate for years.

Advanced Moves for Extra Savings

what else can you do to have more savings?

Maximize Home Improvements

Adding security cameras, water sensors, or a backup generator protects property, which means combined auto-home bundles may earn larger multipolicy percentages.

Adjust Location Factors Wisely

Moving for work? Consider suburban postal codes where accident and theft rates run lower, reducing both auto and property premiums.

Leverage Low-Interest Financing on Premiums

If liquidity is a concern, some carriers offer interest-free monthly plans. Spreading payments avoids using high-rate credit cards.

Five-Step Action Plan

To simplify, here’s our action plan:

- Gather current documents – Pull declarations pages for every vehicle and residence.

- Update personal data – Note mileage, safety upgrades, credit score, and recent life changes.

- Request fresh quotes – Use independent brokers plus at least one direct writer to capture broad ranges.

- Negotiate and bundle – Apply every qualifying discount, raise deductibles that fit your savings cushion, and consolidate policies where math supports it.

- Set annual reminders – Block one hour each year to repeat the cycle so savings never erode.

Final Word

Staying fully protected no longer requires accepting relentless premium hikes. By combining the fifteen strategies above, you can carve meaningful savings and still drive with complete confidence.

Start with the easiest adjustment—often a simple phone call—then layer additional tactics until your coverage cost finally feels fair.