Renting provides flexibility, but it also exposes you to losses that could erase months of savings overnight.

Your landlord’s policy safeguards the structure only, leaving all your belongings and personal liability unprotected. Renters insurance fills that gap by shielding your budget against fire, theft, lawsuits, and costly temporary housing while repairs happen.

This guide explains the coverage, shows why it matters worldwide, and gives you practical tips for choosing a policy that fits your needs.

What Renters Insurance Covers in Plain Language

Renters insurance bundles three core protections into a single policy:

- Personal property reimburses the cost to repair or replace your belongings when they are damaged, destroyed, or stolen by covered perils such as fire, smoke, theft, burst pipes, or severe weather.

- Personal liability pays legal fees, medical bills, and property damage if someone holds you responsible for injuries or accidents.

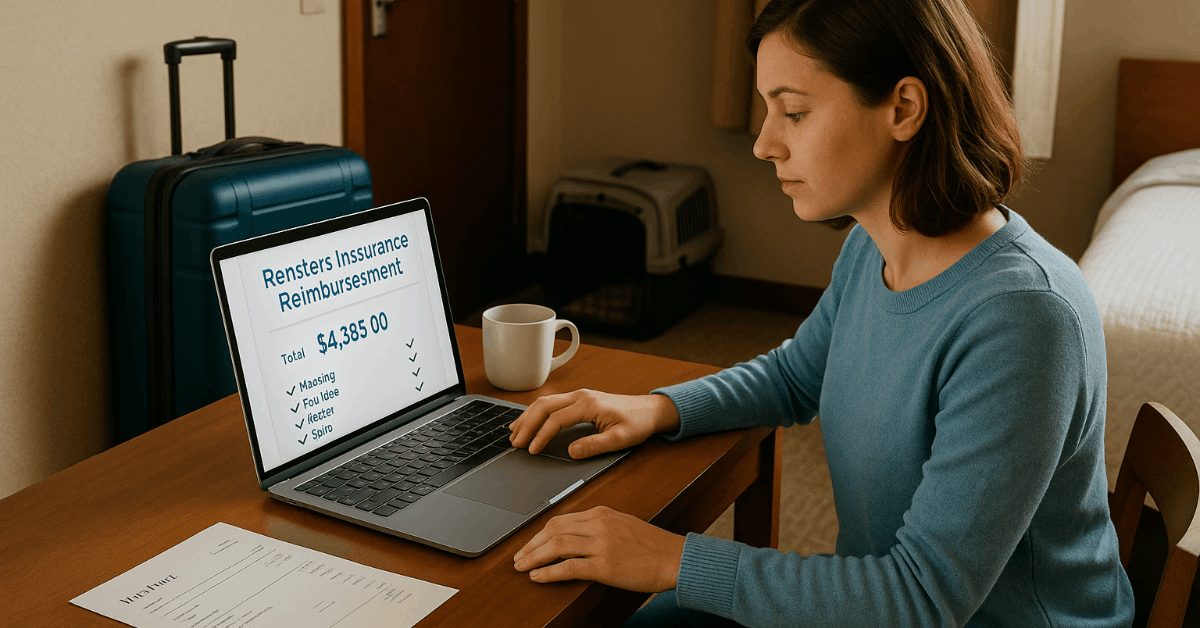

- Additional living expenses (loss of use) absorb the extra costs of hotels, meals, and transportation when a covered event makes your rental unlivable.

Some insurers add identity-theft assistance, pet liability add-ons, or higher limits for valuable jewelry and electronics. Those extras provide worldwide peace of mind for digital nomads and frequent travelers.

Why Many Renters Skip Insurance—and Why That’s Risky

Plenty of tenants assume the landlord’s insurance includes their furniture, laptops, or designer shoes, yet that coverage stops at the walls.

Others think renters insurance costs too much, so they self-insure—until a burglary or kitchen fire hits.

Average worldwide premiums often run less than the price of a weekly coffee run, making this policy one of the most cost-effective financial safety nets available.

Benefit 1: Protection for Your Personal Belongings

Misjudging replacement costs can drain emergency funds quickly. A single burglary could wipe out multiple devices and months of clothing purchases.

Losing a phone hurts, yet losing everything at once is crushing; therefore, the following list shows which items usually receive coverage:

Laptops, desktops, and smart home devices

- Televisions, gaming systems, and high-end headphones

- Furniture sets, mattresses, and area rugs

- Clothing, shoes, and accessories

- Kitchen appliances, cookware, and dining sets

- Sports gear, bicycles, and musical instruments

Insurers reimburse either the actual cash value or the replacement cost. Replacement-cost coverage returns enough to buy new items at today’s prices, so compare both options before signing.

Benefit 2: Liability Coverage Shields Your Savings

An unexpected lawsuit can snowball into five-figure settlements.

What if a guest slips on spilled tea and fractures an arm, which means you face expenses shown in the next list:

- Hospital and rehabilitation bills for the injured visitor

- Legal defense costs and attorney fees

- Court-awarded damages if found negligent

- Damage to other units, such as smoke spreading to a neighbor’s apartment

- Injuries caused by pets are subject to breed restrictions

Standard policies start at $100,000 of liability worldwide, yet doubling that limit often adds only a minimal premium.

Benefit 3: Additional Living Expenses Keep Daily Life Running

Disasters rarely arrive at convenient moments.

Imagine evacuating after a wildfire forces the closure of your building; as a result, covered expenses can include:

- Hotel or short-term rental bills above the normal rent

- Restaurant meals, when cooking at home, are impossible

- Laundry, pet boarding, and extended commuting costs

- Storage fees for salvaged belongings

Policies usually cap additional living expenses at 20% to 30% of personal-property coverage, giving enough cushion for weeks or even months of repairs.

Benefit 4: Surprisingly Affordable Premiums

Premiums vary by region, deductible, building security, and your claims history. Industry data shows averages between $15 and $30 per month in many developed markets worldwide.

Urban high-rise tenants may pay slightly more, while rural renters often pay less. Bundling renters and auto insurance or installing smart smoke detectors typically unlocks discounts.

Benefit 5: Unmatched Peace of Mind

Disasters strike without warning, yet recovering should not bankrupt you. Renters insurance lets you concentrate on finding a new place or replacing damaged items instead of scrambling for funds. That mental relief carries real value on stressful days.

Renters vs. Landlord vs. Homeowners Insurance—At a Glance

Confusion around policy types costs renters money; therefore, the table clarifies which insurance covers which risks:

| Coverage Aspect | Landlord Insurance | Renters Insurance | Homeowners Insurance |

| Building Structure | ✔ | ✖ | ✔ |

| Tenant’s Personal Property | ✖ | ✔ | ✔ |

| Tenant’s Liability | ✖ | ✔ | ✔ |

| Additional Living Expenses | ✖ | ✔ | ✔ |

| Premium Paid By | Landlord | Tenant | Homeowner |

The chart confirms that only renters insurance protects your belongings and liability when you do not own the property.

Seven Practical Tips for Choosing and Using Renters Insurance

A policy works best when customized to your lifestyle.

Follow these pointers first, which means you lock in the right amount of protection without overpaying:

1. Calculate an Accurate Coverage Amount

Add receipts or online prices for all major possessions, then round up to cover future purchases. Many policies start at $20,000 of personal-property coverage, yet tech enthusiasts or collectors often require more.

2. Build a Digital Inventory

Use a cloud drive to store photos, serial numbers, and receipts. This inventory speeds claims and proves ownership, especially while traveling worldwide.

3. Compare Multiple Insurers

Obtain at least three quotes, checking financial strength ratings and claim-handling reviews. Price matters, but responsive service during disasters matters more.

4. Consider Bundling Policies

Many carriers shave 5% to 15% off premiums when renters insurance shares a billing account with auto or life policies. Ask about bundle discounts before committing elsewhere.

5. Review Exclusions and Deductibles

Floods, earthquakes, and pest damage often require separate add-ons. Choosing a higher deductible lowers premiums, yet ensures you can afford that amount during an emergency.

6. Update Coverage After Big Purchases

Notify your insurer when buying new furniture, high-end electronics, or jewelry. Policy riders add specific limits for valuable items, preventing underinsurance.

7. Understand the Claim Process

Save the claims hotline in your phone and know the deadlines for filing. Quick documentation using the digital inventory accelerates reimbursement worldwide.

Frequently Asked Questions

Some questions you might ask:

Does renters insurance cover roommates?

The policy usually covers only named insureds. Roommates should buy individual policies unless explicitly listed, because shared limits reduce payouts per person.

Is renters insurance mandatory?

Some landlords require proof of coverage, while others leave it optional. Even when optional, the low premium makes voluntary coverage a wise move.

Are natural disasters included worldwide?

Standard policies cover many weather-related events, yet floods, earthquakes, or volcanic eruptions often need add-on endorsements. Check local regulations and insurer offerings.

Can students in dorms buy renters insurance?

Yes. Many insurers offer special student packages or allow parents to extend homeowners coverage up to a set dollar amount for college housing.

Key Takeaways

Renters insurance delivers three essential protections—personal property, liability, and additional living expenses—at a cost that rivals a single streaming subscription.

Securing a policy shields your finances worldwide against fires, burglaries, lawsuits, and temporary displacement. Calculate realistic coverage, keep an updated inventory, and revisit limits each year.

Choosing renters insurance today lets you focus on enjoying your rental life tomorrow without fearing financial surprises.