Caring for a pet involves more than love and daily routines. Unexpected health issues can lead to costly vet visits that catch owners off guard. That’s where pet insurance becomes a financial safeguard against unpredictable medical expenses.

It helps ensure that pets receive timely care without overwhelming your savings.

This article explores the value of pet insurance by examining its benefits, costs, coverage, and application requirements.

What Pet Insurance Is and How It Works

Pet insurance is a health policy for pets that reimburses owners for covered veterinary costs. It is not paid directly to the vet in most cases, but returned to you after you submit a claim.

The structure includes premiums, deductibles, and a reimbursement percentage based on your chosen plan.

Some plans offer a flat rate, while others are adjusted according to breed, age, and location. Understanding how this system operates helps owners decide whether insurance is a practical option.

The Difference Between Basic and Comprehensive Plans

Accident-only plans cover emergencies like injuries or poisonings but exclude illnesses. Comprehensive plans include accident coverage plus treatments for chronic diseases, infections, and hereditary conditions.

These broader plans cost more but provide more comprehensive protection. Some policies even offer optional add-ons for dental work, alternative therapies, or wellness care.

Choosing between these levels of coverage depends on your pet’s health risk and your budget.

What Pet Insurance Typically Covers

The extent of your coverage will depend on the policy you choose. Most standard policies include services such as diagnostics, surgery, hospitalization, and medication.

Some plans also cover emergency care and follow-up visits for illnesses. Additional options may include coverage for physical therapy, mobility aids, or prescription food.

These features allow you to tailor your coverage to match your pet’s ongoing needs.

Treatments and Conditions Often Included in Plans

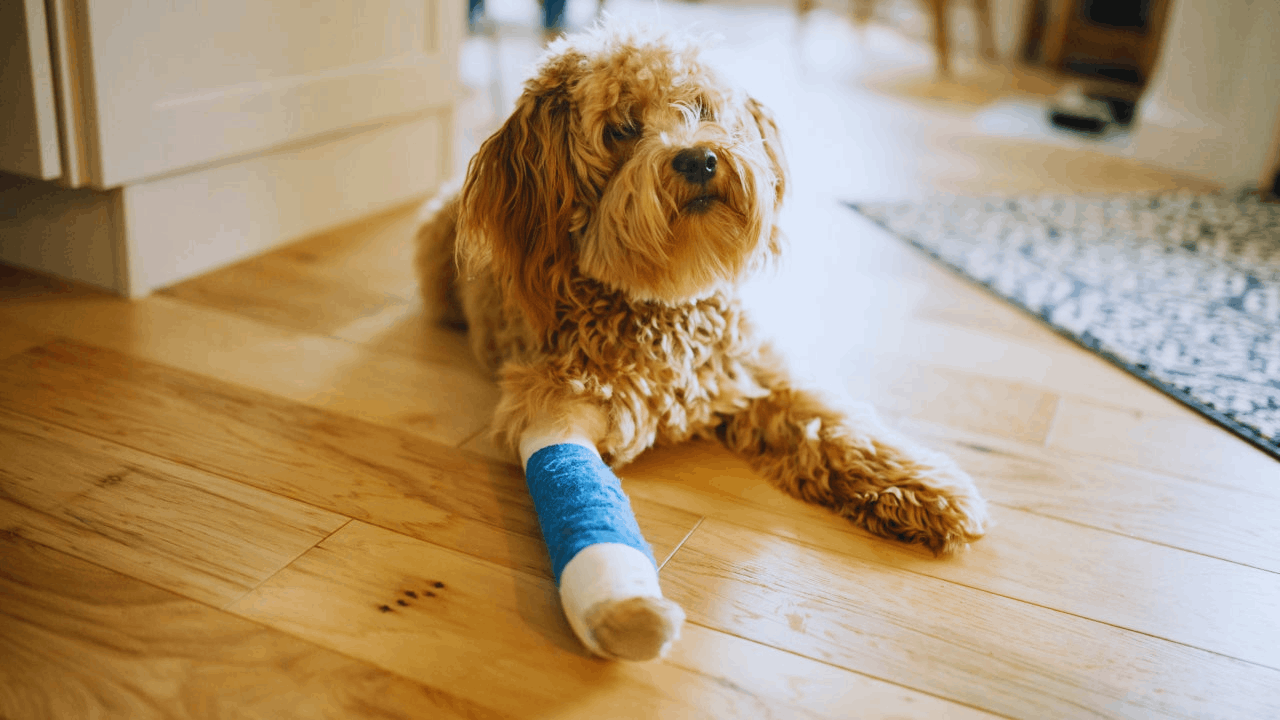

Covered treatments usually include broken bones, infections, organ failure, and certain types of cancer. Many policies also provide support for congenital conditions if diagnosed after enrollment.

Routine procedures like spaying, neutering, and vaccines are usually excluded unless you purchase a wellness rider.

Insurers tend to be clear about exclusions, especially when it comes to pre-existing issues. Knowing what’s included helps avoid misunderstandings during the claims process.

Benefits of Having a Pet Insurance Policy

One major benefit is the ability to seek care quickly without worrying about finances. Insurance makes it easier to access high-quality treatment without delay.

It also supports better long-term health management by making diagnostics and medications more affordable.

Owners are less likely to skip appointments or treatments due to cost. This leads to better outcomes and fewer emergencies over time.

How Insurance Reduces Financial Stress in Emergencies

Veterinary bills for surgeries or hospitalization can climb into the thousands. Insurance allows you to make medical decisions based on what’s best for the pet, not what you can afford on the spot.

A reimbursed portion of those costs gives you breathing room in moments of crisis.

This peace of mind can be especially important when dealing with unexpected injuries or life-threatening conditions. Financial support also helps with recovery by ensuring continuous care.

Costs Involved in Maintaining Pet Insurance

Several variables influence pet insurance costs. Monthly premiums may range from affordable to high, depending on the pet’s age, breed, and risk level.

Deductibles, which you must pay before reimbursement kicks in, also affect pricing.

Plans with lower premiums often have higher deductibles and fewer coverage features. Balancing these factors helps find a policy that fits your financial comfort zone.

What Impacts the Price of Pet Insurance

Older pets typically cost more to insure due to their increased health risks. Some breeds are genetically predisposed to chronic conditions, which also raises rates.

Your geographic location matters, as veterinary costs vary by region. Policies that include wellness and dental care usually have higher premiums. Evaluating these factors in advance can prevent surprise rate hikes later.

What to Know About Reimbursement and Deductibles

Every plan includes a reimbursement rate, usually between seventy and ninety percent. This rate determines how much of the vet bill you’ll get back after paying out-of-pocket.

The deductible is the portion you must pay first before the insurer contributes.

Annual deductibles are more common, but per-incident deductibles are sometimes used. Understanding this math makes it easier to estimate your real savings.

Why Choosing the Right Deductible Is Important

High deductibles result in lower premiums but may limit coverage for minor issues. Low deductibles offer quicker payouts but raise your monthly bill.

The right balance depends on how often your pet sees the vet. If your pet is young and healthy, a higher deductible may be more cost-effective.

Older pets may benefit from a lower deductible to reduce frequent out-of-pocket costs.

How to Qualify and Apply for Pet Insurance

Applying for pet insurance is a straightforward process, typically completed online. Most providers request basic details like age, breed, gender, and medical history.

Some require a recent vet checkup before activating coverage. Once accepted, policies include a waiting period before benefits start. Reading the fine print during this process helps avoid confusion later.

Understanding Waiting Periods and Eligibility Limits

Waiting periods vary by condition, often between two to fourteen days for accidents and illnesses.

Coverage for orthopedic issues or major surgeries may require longer waits. Insurers generally won’t cover conditions that develop during the waiting period.

Some companies limit enrollment for pets above a certain age. Knowing these rules helps you plan before your pet develops long-term health needs.

How Insurers Handle Pre-Existing Conditions

Most pet insurance plans do not cover any condition your pet had before enrollment.

This includes diagnoses, symptoms, or medical records showing ongoing issues. Some providers may reinstate coverage for cured conditions after a symptom-free window.

In rare cases, partial coverage may be offered depending on the provider’s policies. Always check how each insurer defines and handles these exclusions.

Why Medical Records Matter When Applying

Your pet’s health history determines eligibility and cost. Insurers often request vet records to verify the absence of pre-existing conditions.

Providing thorough documentation at the start helps avoid rejected claims. It’s also important to disclose all known medical facts truthfully. Doing so ensures that your policy remains valid and claim-ready when needed.

Types of Pet Insurance Plans You Can Choose From

The three primary types of pet insurance include accident-only, accident and illness, and wellness add-ons.

Accident-only plans are low-cost but exclude disease coverage. Accident and illness policies offer broader support and are more popular among owners.

Wellness plans can be added to cover preventive care like dental cleanings and vaccines. Your pet’s lifestyle and medical history can guide your selection.

Choosing Between Fixed or Flexible Plans

Some providers offer fixed plans with predetermined benefits and limits. Others let you customize reimbursement rates, deductibles, and annual caps.

Flexible plans may cost more but offer better adaptability to your pet’s unique needs.

Fixed plans are simpler but may not fully cover breed-specific issues. Picking the right format makes your insurance more efficient and responsive.

Best Pet Insurance Providers to Consider in 2025

Several companies have established a strong reputation for value and support.

Providers like Embrace and Healthy Paws stand out for offering reliable reimbursement and extensive coverage. Figo appeals to tech-savvy owners with digital tools and fast claim processing.

ASPCA and Spot Pet Insurance offer broader access and competitive wellness packages. Each provider has strengths that align with your budget and priorities.

Evaluating Providers Based on Service and Features

Look for insurers that provide transparent pricing, easy claims, and responsive customer service.

Read reviews to assess how well each company handles emergencies and delays. Some offer mobile apps for filing claims and tracking coverage.

Others have partnerships with clinics for direct payment options. These added features improve the user experience and reduce the stress of managing a sick pet.

Conclusion

Pet insurance helps protect your budget and peace of mind when medical issues arise. It enables timely treatment for emergencies, illnesses, and chronic conditions without draining your savings. Whether your pet is playful or aging, the right insurance plan supports a healthier, more secure future for both of you.