Decentralized Finance (DeFi) is reshaping the financial world by providing alternatives to traditional banking systems.

In 2025, we can expect major advancements in technology, regulation, and use cases within DeFi.

This article explores the future of DeFi, its challenges, and its potential to revolutionize global finance.

The Current Landscape of DeFi

The Decentralized Finance (DeFi) space has rapidly grown, offering an alternative to traditional finance through blockchain technology.

To predict its future, it’s important to examine its current landscape, key players, challenges, and opportunities.

The Core of DeFi

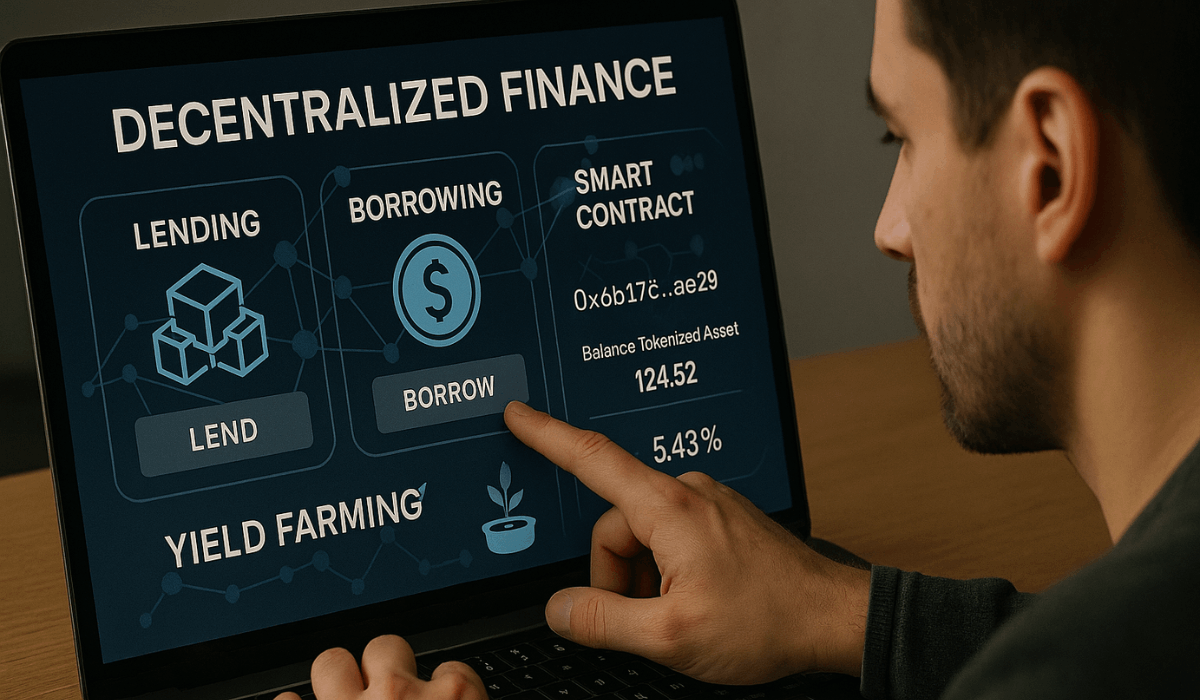

- DeFi refers to a broad range of financial services, including lending, borrowing, trading, and insurance, that are built on blockchain technology.

- These services operate without intermediaries, such as banks or brokers, and are driven by smart contracts.

- The DeFi ecosystem is primarily based on Ethereum, though other blockchains like Binance Smart Chain and Polkadot are emerging.

Major DeFi Platforms and Protocols

- Uniswap: A decentralized exchange (DEX) for trading cryptocurrencies directly from wallets.

- Aave and Compound: Protocols for decentralized lending and borrowing with interest rates determined by supply and demand.

- MakerDAO: A decentralized autonomous organization responsible for creating the DAI stablecoin, a key asset in DeFi.

Key Trends in DeFi

- Yield Farming and Liquidity Mining: Platforms offer users high returns on their crypto holdings in exchange for providing liquidity.

- Staking: DeFi protocols are allowing users to stake tokens, which helps secure the network while earning rewards.

- Tokenization: Real-world assets like real estate and art are being tokenized for trade and investment on DeFi platforms.

Challenges Facing DeFi

- Scalability: High demand on blockchain networks leads to congestion and high transaction fees.

- Security: Smart contract vulnerabilities and exploits have led to major losses in the DeFi space.

- Regulatory Uncertainty: DeFi faces growing regulatory scrutiny over how to classify and regulate decentralized systems.

Opportunities in DeFi

- Financial Inclusion: DeFi enables access to financial services for individuals in underserved or unbanked regions.

- Innovation: New protocols and platforms are emerging, expanding the scope and reach of decentralized finance.

- Institutional Adoption: More traditional financial institutions are exploring how DeFi can integrate with their services.

Technological Innovations Shaping DeFi in 2025

Technological advancements are crucial to DeFi’s growth. In 2025, innovations will improve the efficiency, scalability, and security of DeFi platforms.

Here are the key technologies shaping its future.

Blockchain Upgrades

- Ethereum 2.0: The transition to Proof of Stake (PoS) will improve scalability, reduce energy consumption, and lower transaction fees.

- Layer 2 Solutions: Protocols like Optimism and Arbitrum will enable faster and cheaper transactions by handling them off-chain while maintaining security.

- Polkadot and Cosmos: These interoperable blockchains will enable communication and value transfer between different DeFi platforms.

Smart Contract Improvements

- More Secure and Efficient Contracts: New developments in smart contract languages will make contracts more secure and user-friendly.

- Upgradable Contracts: Future contracts will allow for easier updates without compromising the system’s decentralization.

- Interoperability: Enhanced smart contract integration across various DeFi protocols will increase flexibility and usage.

Artificial Intelligence (AI) Integration

- AI-Powered Trading: AI will help optimize trading strategies, predict market trends, and automate decision-making processes.

- Risk Management: AI will be used to assess and manage risks in DeFi, offering more accurate predictions of potential vulnerabilities and attacks.

- Automated Customer Support: AI chatbots will provide users with real-time assistance and automate complex tasks.

Quantum Computing

- Blockchain Security: As quantum computing develops, it may pose a threat to current cryptographic methods, prompting new quantum-resistant algorithms.

- Faster Processing: Quantum computing could significantly speed up transaction processing and data analysis in DeFi networks.

- Smart Contract Optimization: Quantum advancements may help in creating more complex and efficient smart contracts.

Zero-Knowledge Proofs (ZKPs)

- Enhanced Privacy: ZKPs will allow transactions to be verified without revealing sensitive user information, improving privacy.

- Scalable Solutions: ZKPs will enable more scalable DeFi applications by reducing the amount of data needed for verification.

- Privacy Coins: ZKPs will help in the development of privacy-focused coins and tokens that ensure confidential transactions.

Decentralized Oracles

- Secure Data Feeds: Decentralized oracles like Chainlink will provide reliable external data to DeFi platforms without relying on centralized authorities.

- Smart Contract Inputs: Oracles will be essential in enabling smart contracts to interact with real-world data, such as price feeds or weather conditions.

- Cross-Chain Oracles: These oracles will allow DeFi platforms to source data from multiple blockchains, increasing interoperability.

Regulatory Landscape in DeFi

The DeFi regulatory landscape is evolving as governments tackle challenges with decentralized systems.

Regulators aim to balance innovation and consumer protection. Here’s an overview of the developments shaping DeFi’s future.

Current Regulatory Challenges

- Unclear Guidelines: DeFi lacks standardized regulations, making it hard for regulators to define and control.

- Jurisdiction Issues: Decentralized systems create conflicts about which laws apply across borders.

- Taxation: The impact of DeFi on tax policy, especially regarding yield farming, remains unclear.

Expected Regulatory Developments

- Global Frameworks: Countries may adopt global standards for DeFi, like the FATF guidelines for crypto.

- Licensing and Compliance: DeFi platforms may need licenses and must comply with AML and KYC regulations.

- Stablecoin Regulation: Stablecoins, widely used in DeFi, are likely to face tighter regulation.

Government Involvement

- CBDCs: Central Bank Digital Currencies could impact DeFi adoption.

- DeFi Partnerships: Governments may collaborate with DeFi platforms to integrate decentralized finance.

- Legal Clarity: Countries like Switzerland and Singapore provide legal clarity, encouraging wider adoption.

Impact of Regulation on Innovation

- Innovation vs. Safety: Regulators must balance fostering innovation with ensuring consumer protection.

- Risk of Overregulation: Too much regulation could stifle DeFi growth.

- Decentralized Governance: Regulations might require more transparency in DeFi governance, which could compromise decentralization.

The Role of Self-Regulation

- Industry Standards: The DeFi community may create self-regulatory standards to ensure security and ethics.

- DeFi Governance: DAOs could regulate themselves and adapt to legal changes.

- Transparency and Audits: DeFi platforms may voluntarily adopt transparency measures to avoid regulatory intervention.

Risks, Challenges, and Security Concerns in DeFi

DeFi offers benefits but also faces significant risks and challenges. Addressing these issues is key to its security and growth.

Here are the main risks and challenges affecting DeFi.

Security Risks

- Smart Contract Bugs: Errors in smart contracts can be exploited, leading to financial losses.

- Hacks and Exploits: DeFi platforms are frequent targets for hackers, resulting in major breaches.

- Rug Pulls: Fraudulent developers abandon projects, stealing investors’ funds.

Scalability Issues

- High Fees: Network congestion, especially on Ethereum, causes high transaction fees.

- Slow Transactions: Increased users may slow down blockchain performance, causing delays.

- Network Overload: Too many transactions can destabilize the blockchain network.

Regulatory Uncertainty

- Legal Ambiguity: DeFi operates in a regulatory grey area, making legal obligations unclear.

- Regulation Risks: Governments may impose stricter rules, limiting DeFi’s growth.

- Compliance Costs: Regulatory requirements, like AML and KYC, could increase costs for DeFi platforms.

User Experience and Accessibility

- Complex Interfaces: DeFi platforms often have complicated interfaces, which can be challenging for newcomers.

- High Entry Barriers: DeFi requires blockchain and crypto knowledge, limiting accessibility.

- Lack of Education: Many users don’t fully understand the risks, like volatility and uninsured funds.

Market Volatility

- Price Fluctuations: DeFi assets can experience significant price swings, causing losses.

- Liquidity Risks: DeFi platforms may face low liquidity, hindering trades.

- Impermanent Loss: Liquidity providers may lose value due to price fluctuations in liquidity pools.

Environmental Impact

- Energy Consumption: Proof-of-Work blockchains consume a lot of energy, raising environmental concerns.

- Carbon Footprint: Large-scale DeFi operations may increase blockchain networks’ carbon footprint.

The Bottomline

While DeFi offers innovative opportunities, it also faces significant risks and challenges that must be addressed for long-term success.

As the space evolves, developers, regulators, and users must collaborate in creating a secure and sustainable ecosystem.

Stay informed and proactive in understanding these risks to navigate the future of decentralized finance safely.