Cryptocurrency markets are known for their high volatility and rapid changes.

To manage risk effectively, you need to diversify your cryptocurrency portfolio across different asset types and sectors.

This guide will show you practical strategies to build a balanced portfolio that stays strong in uncertain conditions.

Understanding Crypto Market Volatility

Cryptocurrency prices move fast and often without a clear reason. Knowing what drives these swings helps you make smarter decisions.

Here’s what you need to understand:

- Market Sentiment: Prices often react to fear, hype, or social media trends rather than fundamentals.

- Regulatory News: Government announcements or bans can cause sudden market drops or rallies.

- Low Liquidity: Many crypto assets are thinly traded, making them more sensitive to large buys or sells.

- Speculation and Whales: Large holders (“whales”) and speculative traders can trigger major price shifts.

- Global Events: Economic shifts, wars, or financial crises affect crypto the same way they do traditional assets.

- Technology Changes: Network upgrades, forks, or project delays can cause temporary spikes or dips.

Types of Crypto Assets to Include

To diversify your cryptocurrency portfolio effectively, you need to hold different types of assets.

Each category serves a unique purpose and helps reduce overall risk. Here are the main types to consider:

- Layer 1 Coins: These include foundational networks like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) that support entire ecosystems.

- Utility Tokens: Used to access services or pay fees within platforms—examples include Chainlink (LINK) and Filecoin (FIL).

- Stablecoins: Pegged to fiat currencies like USD; Tether (USDT) and USD Coin (USDC) help maintain portfolio stability.

- Governance Tokens: Holders can vote on protocol changes; examples include Uniswap (UNI) and Aave (AAVE).

- Security Tokens: Represent ownership in real-world assets and comply with financial regulations.

- Emerging Altcoins: Smaller projects with high growth potential but higher risk—research deeply before investing.

Strategies to Diversify Your Portfolio

Having a mix of different crypto assets is only part of the process. You also need the right strategies to manage them wisely.

Here are practical ways to diversify your cryptocurrency portfolio:

- Spread Across Sectors: Invest in a mix of categories like DeFi, NFTs, gaming, infrastructure, and privacy coins to reduce sector-specific risks.

- Use Risk-Based Allocation: Divide your portfolio into core (low-risk), growth (moderate-risk), and speculative (high-risk) sections.

- Apply Dollar-Cost Averaging (DCA): Invest a fixed amount regularly to reduce the impact of price swings over time.

- Hold Some Stablecoins: Keep a portion in stablecoins for quick buys during market dips or to minimize exposure.

- Rebalance Periodically: Adjust your holdings every month or quarter to stay aligned with your risk level and goals.

- Limit Overexposure: Set percentage caps for each token or sector to avoid relying too heavily on a single asset.

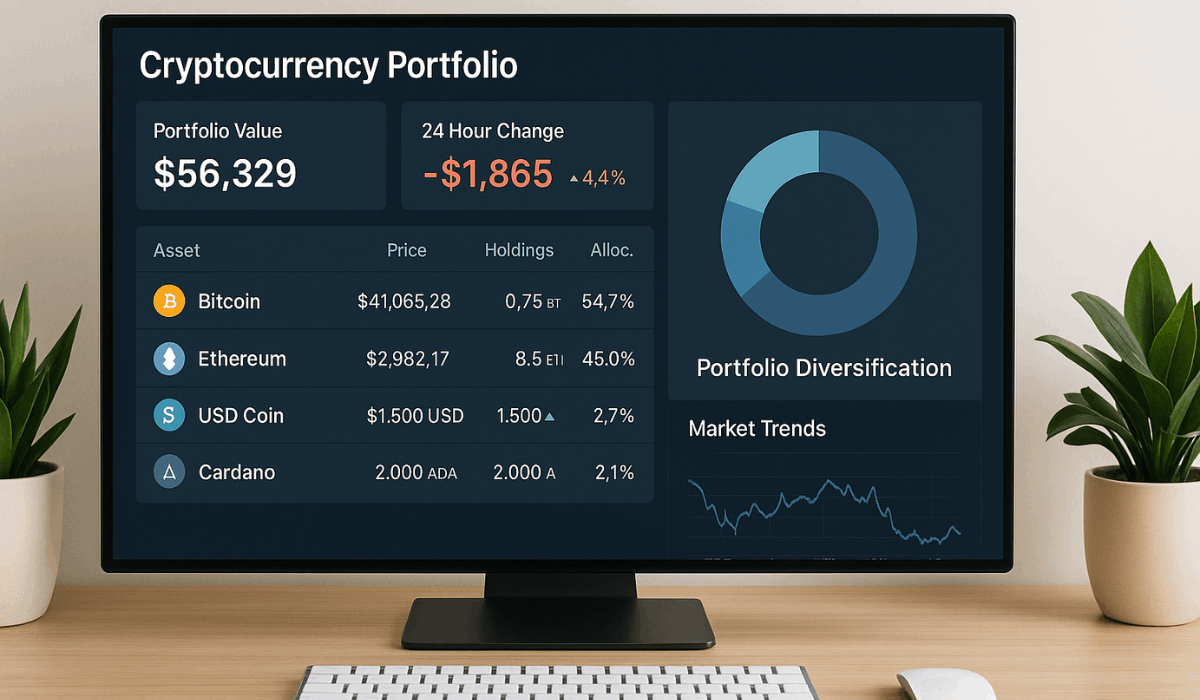

Tools to Track and Rebalance Your Portfolio

Staying organized is key when managing multiple crypto assets. The right tools help you monitor performance and rebalance when needed.

Here are reliable tools you can use:

- CoinStats: Lets you track all your holdings across wallets and exchanges in one place with real-time data.

- Delta: A mobile-friendly app that offers portfolio analytics, price alerts, and news tracking.

- CoinGecko Portfolio: A web-based tracker that lets you manage multiple crypto holdings and monitor live market prices.

- Shrimpy: Automates portfolio rebalancing based on your set strategy and supports various exchanges.

- Kubera: Combines crypto and traditional asset tracking, ideal for users with a mix of investments.

- Zerion: Best for DeFi portfolios, allowing you to track tokens and interact directly with Web3 wallets.

Set Your Investment Goals and Time Horizon

Before investing in crypto, you need a clear plan. Defining your goals and timeline helps you choose the right assets and manage risk.

Here’s how to set them effectively:

- Identify Your Purpose: Are you investing for short-term gains, long-term wealth, or passive income? Define it early.

- Decide on a Time Frame: Know whether your horizon is short-term (under 1 year), medium-term (1–3 years), or long-term (3+ years).

- Match Assets to Goals: Use stablecoins or top-tier coins for short-term, growth tokens for long-term potential.

- Set Profit Targets: Define when you’ll take profits or exit—based on price levels or percentage gains.

- Manage Your Risk: Allocate more capital to lower-risk assets if you have a short timeline.

- Review Regularly: Reassess your goals and time frame every few months as markets or your needs change.

Monitor News and Regulatory Trends

Staying updated with news and regulations helps you avoid sudden losses.

Crypto markets react quickly to global events and policy changes. Here’s what to watch:

- Follow Regulatory Updates: Track crypto laws in major regions like the U.S., EU, and Asia to anticipate market shifts.

- Watch Central Bank Announcements: Interest rate changes or digital currency plans can affect overall sentiment.

- Track Project-Specific News: Keep an eye on updates from the teams behind the tokens you hold.

- Use Reliable News Sources: Follow sites like CoinDesk, CoinTelegraph, and official Twitter accounts for verified info.

- Join Community Channels: Use Telegram, Discord, and Reddit groups for real-time alerts and discussion.

- Be Alert to Legal Risks: Some tokens may face delisting or legal action—always check compliance and status.

Use Cold Storage for Long-Term Holdings

If you’re holding crypto for the long term, security should be your priority. Cold storage keeps your assets offline and safe from hacks.

Here’s what you need to know:

- Understand Cold vs. Hot Storage: Cold wallets are offline (e.g., hardware wallets), while hot wallets stay online and are more exposed to risks.

- Choose a Hardware Wallet: Devices like Ledger or Trezor store your private keys securely and support a wide range of tokens.

- Backup Your Recovery Phrase: Write down your seed phrase and store it in a safe place—never share it online.

- Keep Cold Storage for Major Holdings: Use it for Bitcoin, Ethereum, and any tokens you don’t plan to trade often.

- Avoid Storing on Exchanges: Exchanges are targets for hacks—move your crypto to cold storage after buying.

- Update Firmware Regularly: Keep your device secure by installing updates from the official manufacturer.

Mistakes to Avoid When Diversifying

Diversification helps reduce risk, but doing it wrong can still hurt your portfolio. Avoid these common mistakes to keep your strategy effective:

- Holding Too Many Similar Tokens: Don’t invest in multiple assets that serve the same purpose or belong to one sector.

- Ignoring Stablecoins: Skipping stablecoins limits your flexibility and protection during market dips.

- Chasing Hype Projects: Buying tokens just because they’re trending can lead to significant losses.

- Over-Diversifying: Holding too many assets makes it harder to manage and track performance.

- Failing to Rebalance: Letting your portfolio drift from its target mix increases risk over time.

- Not Researching Assets: Investing without understanding a token’s purpose or fundamentals leads to poor decisions.

To Conclude

Diversifying your cryptocurrency portfolio is essential for reducing risk in a volatile market.

By using the right mix of assets, strategies, and tools, you can protect your investments and stay on track with your goals.

Start reviewing your portfolio today and apply these steps to build a more balanced and resilient crypto strategy.