A claim is easier when the first steps protect people, preserve evidence, and prevent extra loss that could complicate coverage decisions.

Because policies and local requirements differ, use these steps as a practical checklist while also following your insurer’s instructions.

Step 1: Make it safe and stop the loss from getting worse

Put safety first by moving away from hazards, and call emergency services when needed.

If you can do so safely, take quick actions to prevent further damage, such as covering openings, shutting off water, or moving items out of active danger.

Avoid throwing anything away until you have documented it, because damaged property can be important evidence for the adjuster’s inspection.

If you must dispose of items for health or safety reasons, capture clear photos first and keep a short written note explaining why disposal was necessary.

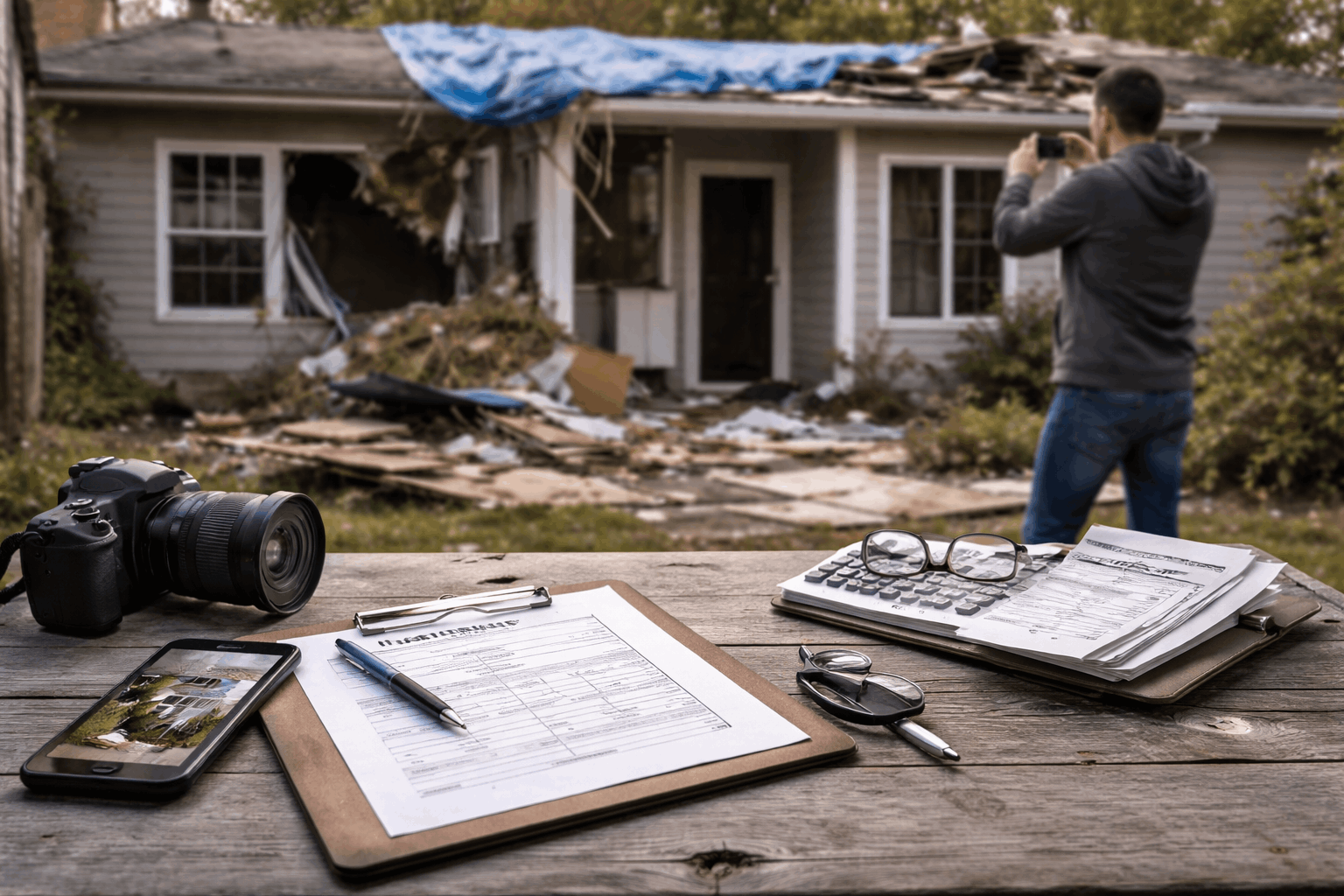

Step 2: Document the scene and build a claim “paper trail” immediately

Start with a simple timeline that lists the date and time of the event, what you noticed first, and what actions you took.

Take photos and video before major cleanup or repairs whenever it is safe, because images from multiple angles help show the scope and cause of damage.

Create a dedicated folder for everything related to the claim, including emails, letters, claim numbers, call notes, and names.

Keep copies of every document you send or receive, including your item lists and any estimates, so you can quickly resolve disagreements.

Photos, video, and an item-by-item inventory

Photograph damaged areas wide and close-up, then make a list of what was lost or damaged with details like brand, approximate age, and condition.

If you do not have a home inventory already, begin one right away from memory and receipts.

When possible, keep damaged items available for inspection, since insurers may need to see them to confirm loss details and causation.

Receipts, temporary repairs, and extra living costs

Save receipts for disaster expenses, repairs, and replacements, because reimbursement often depends on proving what you spent and why.

If you make temporary repairs to prevent further damage, document what you did and keep receipts for materials and labor.

Track additional living expenses if you cannot stay at home, and keep receipts for lodging, meals, and essential costs that may be covered.

Step 3: Notify the right parties and file reports in the right order

Contact your insurer or agent as soon as you can, because early notice helps start the claim file and triggers next steps.

Ask what documentation they want first, how to submit it, and whether they prefer temporary repairs to be approved before you proceed.

If theft, vandalism, or a vehicle incident is involved, a police report number can be a key requirement for coverage decisions and recovery efforts.

If you are unsure which policy applies, file notice anyway and describe what happened, because the insurer can help route you to the correct coverage type.

Damage to home or property: start the claim with clear basics

Be ready to share your policy information, current contact details, and a working list of damaged or missing items when you report the loss.

Provide a short description of what happened, the date and location, and whether you have already taken temporary steps to prevent more damage.

If a disaster affects many homes at once, follow official guidance on what information is needed for an insurance claim and keep all claim-related receipts.

Theft and identity-related loss: report fast and protect accounts

If a vehicle is stolen, report it to law enforcement first and then notify your insurer, since insurers commonly require the police report.

Gather identifiers such as the vehicle’s make, model, color, license plate, and VIN if available, because they help to confirm the correct asset.

If personal information or accounts were stolen or misused, report identity theft through the federal reporting process.

Accidents and liability situations: be factual and consistent

Call for medical help when needed and follow local reporting rules, because health and safety decisions should come before insurance and paperwork.

Stick to objective facts when describing the event to your insurer, and avoid guessing about fault or causes before an investigation.

Write down names, contact details, and what you observed, because early notes are often more accurate than memories formed days later.

Step 4: Work with the adjuster and choose repairs without creating new problems

Ask when the adjuster will inspect, what to do if repairs cannot wait, and how to submit estimates so you do not miss required steps.

Request that important decisions be confirmed in writing, such as what is covered, what is excluded, and what documentation is still needed.

Avoid rushing into permanent repairs or full replacements until you understand how your policy settles claims.

Estimates, contractors, and payment basics

Get detailed written estimates that break down labor and materials, because itemized bids make it easier to compare scopes.

If a contractor pressures you to sign quickly or take unusual payment terms, pause and verify requirements with your insurer first.

Keep a log of all repair communications and store invoices and receipts, because they are often needed to support reimbursement.

Step 5: Track deadlines, resolve disputes, and close the claim cleanly

Maintain a running checklist of what the insurer asked for, when you submitted it, and what you are still waiting on.

Review settlement documents and match them to your inventory and receipts, because small line-item errors can add up across many items.

If something is denied or underpaid, ask for the specific policy language and the evidence used, then respond with your documentation.

If fraud or identity issues are part of the loss, keep your official reports and recovery documents together, since they may be needed.

Appeals, complaints, and when to seek extra help

Start by escalating within the insurer using the claim number and a clear written summary.

If you cannot resolve the issue, your state insurance department or consumer resources can explain complaint options.

For identity theft recovery, follow the step-by-step plan from the official reporting process, since it is designed to help you limit damage.

Conclusion

Handle the first hour by focusing on safety and preventing more loss, because that protects people and preserves the story of what happened.

Handle the first day by documenting thoroughly and saving receipts, because proof and organization are what drive a smoother claims decision.

Handle the next steps by reporting to the right parties and keeping everything in one file, because consistency reduces delays and confusion.